PROPTRADE is a trading experience provider and a proprietary trading company.

Our objective is to find ways to lower the barriers to adoption of our trading model while seeking the lowest possible risk to our clients.

By subscribing to our service, you gain access to an account funded with virtual capital and an analysis of our strategy via copy trading. No deposits are needed, eliminating any risk to your capital. Pay only subscription fee.

This experience allows you to engage and observe our trading in real-time, offering a delightful and insightful view into our methods. We hope you will become our brand ambassador, sharing your testimonials and our service, increasing our visibility within your community and social media, which will attract more clients.

In return, we would like to share our success with you through rewards. While are many ways to structure a reward system; however, tying it to the trading performance of PROPTRADE’s own model trading strategy is ideal, as that is our main strategy. Profit-sharing based on its trading results aligns our success with yours. When you win, we win, and we all win.

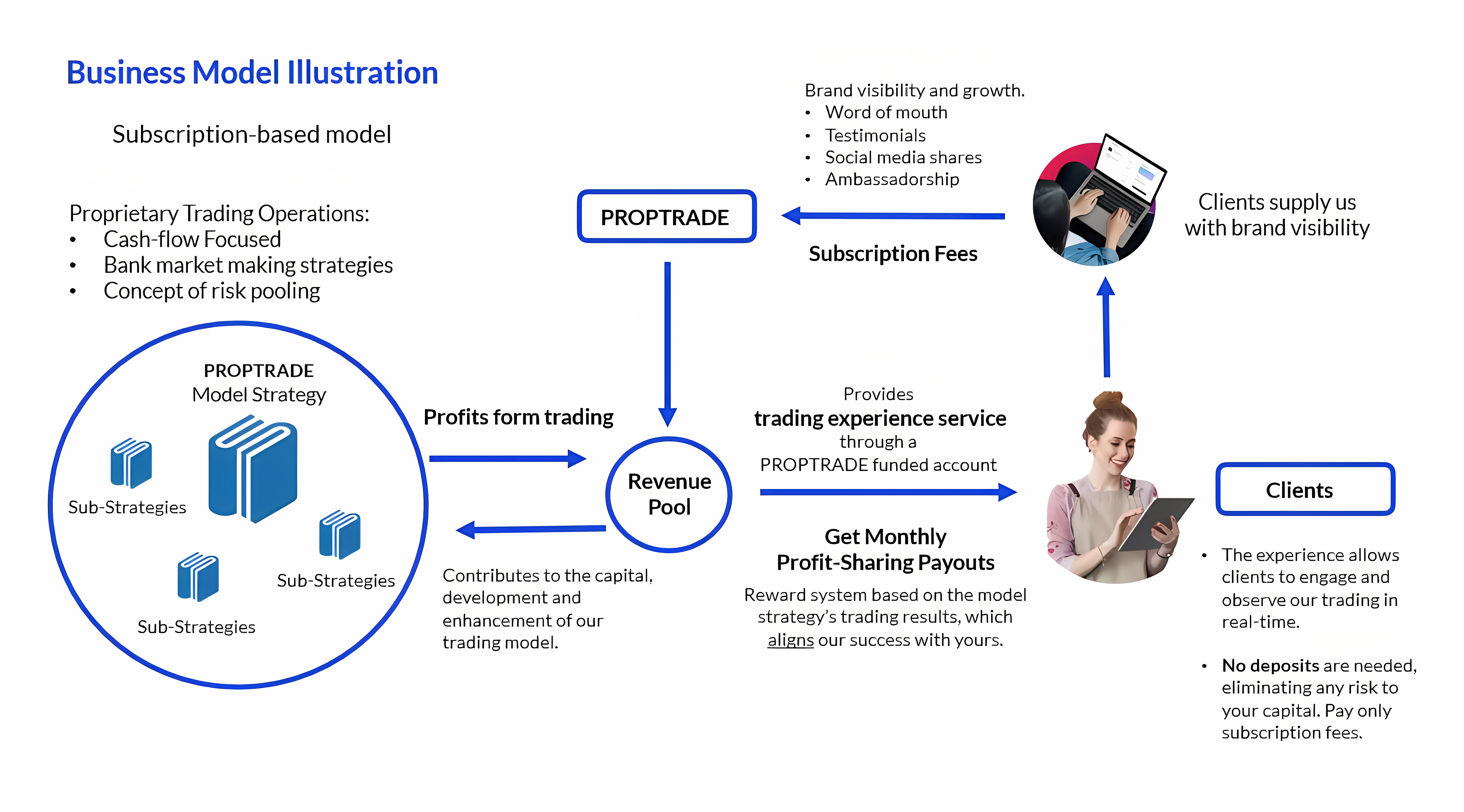

Subscription-based Model

Have you ever wondered how paying small insurance premiums entitles us to much larger payouts during claims? How did the insurance company do it? You can liken our subscription fee as the insurance premium and your funded account as the "insurance payout"; difference is that this "payout" cannot be withdrawn and exists as your virtual capital.

Taking inspiration on the insurance company model, we are able to provide a funded account without you putting any capital. Here are 3 reasons why:

1. Virtual Funding

The funds you see in the account are virtually credited with a nominal value. They are a bonus credit that cannot be withdrawn.

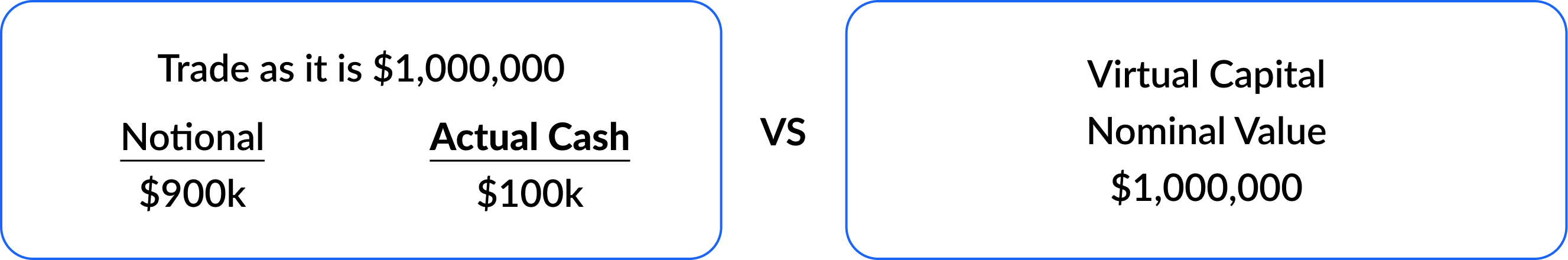

2. Use concept of Notional Funding

Notional funding is a well-known financial concept of “trade as if you have the amount” for futures/forex, where trading activities are based on a nominal value of money rather than the actual deposit amount. It is possible because at any given time, only a small percentage of that nominal value is used as margin, For example, it is possible to trade a nominal $1,000,000 account with a cash deposit of just 100k.

Illustration:

PROPTRADE uses this approach for our trading operations. We don’t need to have the full amount available in the trading accounts because, in markets like forex, availability of high leverage (ranging from 100 to 500 times) allows us to control larger positions with a relatively small capital as margin. The capital deployed for trading can be just a fraction of client’s virtual capital amount. Drawdowns* are targeted to be within limits of <15% using hedging and the concept of risk pooling.

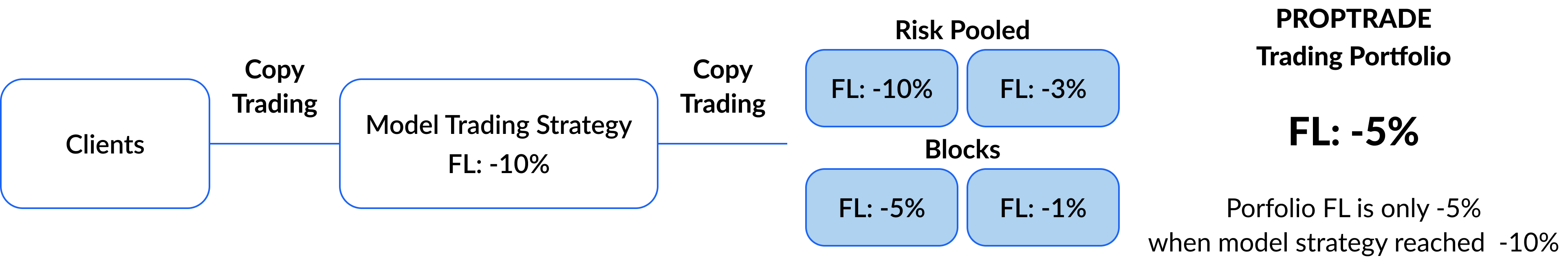

3. Use concept of Risk Pooling in trading to reduce risks

Risk pooling is a widely used strategy in the insurance industry. The idea is to spread and share risks across a large group of policyholders. This approach helps reduce the potential impact of significant losses on any single person. Instead of one person bearing the full brunt of a loss, the risk is distributed across many people, making the loss more manageable.

At PROPTRADE, we’ve adopted a similar method for our trading operations. We divide our trading capital into several "blocks," and each block is deployed to trading across different strategies and time periods. These blocks are then pooled together to share the risk of drawdowns* as a collective portfolio. A “value at risk” limit is set where we will start hedging if breached.

Illustration:

*we more commonly refer to drawdowns as floating losses (FL).

The advantage of this approach is that it mitigates the impact of any single block’s drawdown. Not every block will experience a drawdown at the same time or to the same degree, so when drawdowns do occur, they are distributed across the entire pool rather than being confined to one. This distribution of risk makes it easier to predict and manage the overall risk level of our trading operations.

OUR REVENUE

● PROPTRADE’s trading profits with own funds

● Client subscription fees

WHY SHARE

Majority of our revenue comes from trading our own funds. PROPTRADE benefited from the subscription fees received as It contributes to the capital, development and enhancement of our trading model which leads to more consistent revenue.

Clients supply us with more visibility by sharing their testimonials with us, with their friends and on social medias, pushing organic reach that can resonate a lot more, generating more revenue.

PROPTRADE then shares the company’s revenue (trading profits) with clients via a reward system. It is only fair we share our success.

There are many ways to structure a reward system; however, tying it to the trading performance of PROPTRADE’s own model proprietary trading is ideal, as that is our main strategy. Profit-sharing based on its trading results aligns our success with yours. When you win, we win, and we all win.

PROPTRADE is a commercial name used by FX2 Asset Management, a regulated asset manager with BVI FSC registration number SIBA/PIPO/20/5048 since 2020. However, as a proprietary trading company, the services provided by PROPTRADE are not subject to financial regulation.

As a customer, you subscribe to a service that gives you access to a trading account funded with virtual capital that allows you to experience our proprietary trading strategy via copy trading. Copy trading on a virtually funded account is generally not considered an investment service as no real capital are involved.

Traditional asset management investment services involve assets from clients as deposits in return for investment services. In our case, you do not need to deposit any funds. You simply pay a fee to access a read-only account funded with virtual capital. This allows you to engage and see in real-time how we trade and be delighted. In return, you supply us with more visibility by sharing your testimonials with us, with your friends and on social medias as part of a purpose driven marketing campaign.

The trading model is executed by a system with more than 100 strategies spread across as many traded instruments as possible, mainly focusing on forex. The design is based on a bank's market-making trading desk. The target is to earn many small but very consistent profits, which we call spreads. This is where the monthly income comes from. 20%-25% per year returns is considered very good.

However, such a trading style can result in open positions (inventory) that cannot be closed with a profit in the short term and need to be managed within our risk limits (floating loss target <15%). These positions need to be eventually eliminated from the inventory using techniques like hedging, dollar-cost averaging or waiting for favourable market conditions, which may last months. Our experience in banking gives us the expertise to manage these situations effectively.

Past performance is not indicative of future results and certainty not guaranteed. Market conditions are unpredictable, and there is always a risk of loss.

However, We have created an innovative process where you can participate without capital risk. Help us spread the good words.

The nature of our model proprietary trading strategy requires operating with a constant floating drawdown (inventory loss) ideally ranging from 2% to 15%, which may take many months to eliminate. This results in a low Sharpe ratio, which might not be attractive to institutional investors managing hundreds of millions of dollars who may want to be more liquid.

Running a hedge fund of that size involves very high costs as well, and often they can only accept accredited clients with a minimum investment of $250,000. This makes it inaccessible to the majority of the population, which is not our objective.

We firmly believe that our approach is a good way for the average person, without cutting-edge technology or privileged information, to achieve sustainable and reasonable returns. Our trading belief can be summarized in the following formula:

Sum of small collected income > expected and controlled range of inventory loss (floating loss) = Capital low risks status

We currently only offer read-only Match-Trader web and mobile platform for copy trading. Meaning you are unable to place any trades.

Unfortunately, it cannot be withdrawn. Instead, you can add more capital using your monthly payouts in the USDT wallet. Get 10 times the amount you pay. Minimum USD 10.

The trades in your PROPTRADE account are mirrors of our model prop trading account. You can check this on myfxbook.com, a third-party verification platform, where we displayed for your verification. The funds in this account are real funds that we trade.

You may notice slight differences in executed prices at times, resulting in occasional small discrepancies in trading results. This is because our model account's trading is conducted on our broker’s MT5 platform, while clients use a vendor platform, match-trader. These platforms are hosted on different servers with distinct price feeds from various liquidity providers. This important because it ensures there's no chance for price manipulation to fake trading results.

Many of our clients compare the trades with other forex brokers to check authenticity. You can do that too, and we are confident you will be convinced of our trading.

Your account mirrors the same trades as our trading accounts, to which we have committed millions. You can verify this by cross-referencing the trades in your account with ours on myfxbook.com. Our company’s revenue model relies heavily on trading income, so it makes no business sense for us to perform poorly on purpose and lose substantial amount of our own funds. While trading results are never guaranteed, our objective is always to win.

PROPTRADE also has a “Under-Performance Refund Policy" where it will automatically refund 50% of the annual fee if, over the past 12 months, more than 6 months showed results below 1%. Additionally, it will also auto refund one month’s worth of fees if the previous 3 month’s results are below 1%. Once again, trading results are never guaranteed and cannot be controlled, but the company is demonstrating to our clients that there is no conflict of interests.

Lastly, our business model is based on repeat subscriptions and brand visibility. It really makes no sense to perform poorly on purpose and lose clients, both current and new.

F01, Level 2, Gateway Suite, Jalan Kerinchi, Gerbang Kerinchi Lestari,

59200, Kuala Lumpur

Open to all clients excluding US Persons. PROPTRADE and the www.prop-trade.com domain are commercial names used by FX2 Asset management Limited, a BVI FSC regulated fund with registration number SIBA/PIPO/20/5048. All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. PROPTRADE only provides services of simulated trading and educational tools for clients. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.

© 2024 PropTrade. All Rights Reserved.